QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report “Alanyl-Glutamine- Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032”. Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2026-2032), this report provides a comprehensive analysis of the global Alanyl-Glutamine market, including market size, share, demand, industry development status, and forecasts for the next few years.

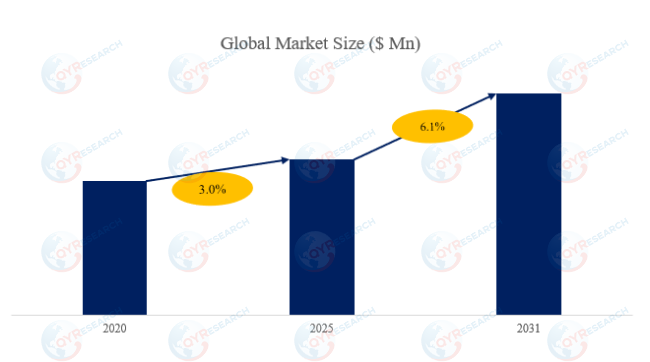

The global market for Alanyl-Glutamine was estimated to be worth US$ 149 million in 2024 and is forecast to a readjusted size of US$ 222 million by 2031 with a CAGR of 6.1% during the forecast period 2025-2031.

【Get a free sample PDF of this report (Including Full TOC, List of Tables & Figures, Chart)】

https://www.qyresearch.com/reports/4757034/alanyl-glutamine

Alanyl-Glutamine (Ala-Gln) Market Summary

Alanyl-Glutamine (Ala-Gln) is a dipeptide composed of the amino acids L-alanine and L-glutamine. It is a highly stable and water-soluble form of glutamine designed to overcome the limitations of free glutamine, which is chemically unstable in solution and heat-sensitive. Because of this, Ala-Gln is widely used in medical nutrition, sports supplements, and emerging fields like animal feed.

Figure00001. Alanyl-Glutamine (Ala-Gln) Product Picture

Above data is based on report from QYResearch: Global Alanyl-Glutamine (Ala-Gln) Market Report 2024-2031 (published in 2024). If you need the latest data, plaese contact QYResearch.

According to the new market research report “Global Alanyl-Glutamine Market Report 2025-2031”, published by QYResearch, the global Alanyl-Glutamine market size is projected to reach USD 0.22 billion by 2031, at a CAGR of 6.1% during the forecast period.

Figure00002. Global Alanyl-Glutamine (Ala-Gln) Market Size (US$ Million), 2020-2031

Above data is based on report from QYResearch: Global Alanyl-Glutamine (Ala-Gln) Market Report 2024-2031 (published in 2024). If you need the latest data, plaese contact QYResearch.

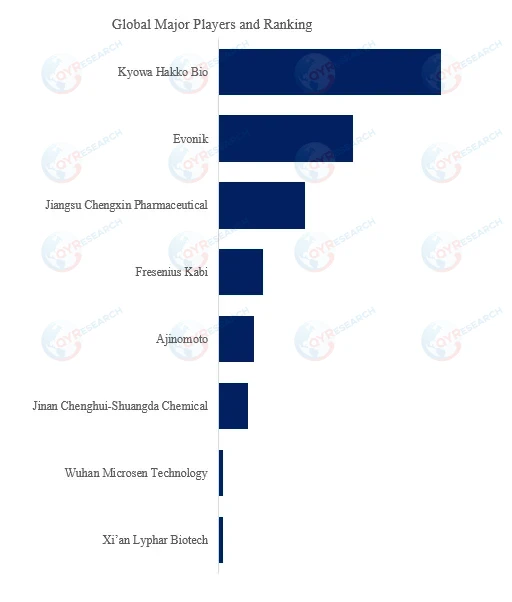

According to QYResearch Top Players Research Center, the global key manufacturers of Alanyl-Glutamine include Kyowa Hakko Bio, Evonik, Jiangsu Chengxin Pharmaceutical, Fresenius Kabi, Ajinomoto, Jinan Chenghui-Shuangda Chemical, Wuhan Microsen Technology, Xi’an Lyphar Biotech, Company 9, Company 10, etc. In 2024, the global top five players had a share approximately 86.0% in terms of revenue.

Table 1. Global Alanyl-Glutamine (Ala-Gln) Industry-Chain Analysis

Above data is based on report from QYResearch: Global Alanyl-Glutamine (Ala-Gln) Market Report 2024-2031 (published in 2024). If you need the latest data, plaese contact QYResearch.

The Ala-Gln industry presents multiple opportunity vectors across the chain.

Value migration to higher-margin products. Manufacturers that move from selling bulk powder to providing sterile, ready-to-use PN solutions, or co-developing hospital-specific formulations, can capture higher margins and strengthen client relationships.

Green manufacturing premiums. Firms adopting enzymatic or fermentation routes that demonstrably reduce solvent use, energy consumption, and waste can market “sustainable peptide” credentials—valuable to institutional buyers and compliant with rising ESG procurement criteria.

Expansion into emerging markets. Hospitals and clinical nutrition demand in emerging economies is growing. Regional suppliers that can meet quality requirements while offering competitive pricing can secure volume and build brand recognition.

Contract manufacturing and technical services. Smaller clinical nutrition brands or pharma companies often lack sterile manufacturing capabilities. CMOs offering turnkey Ala-Gln sterile filling, stability data, and regulatory support can be significant growth engines.

Product differentiation via combination formulations. Blending Ala-Gln with other condition-specific nutrients (immune modulators, antioxidants, or probarrier agents) opens product niches—post-operative recovery, oncology nutrition, ICU immunonutrition—where clinical evidence supports differentiated outcomes and premium pricing.

Research and cell-culture markets. Precision cell-culture media needing stable glutamine sources represent a recurring niche: biopharma firms and contract research organizations (CROs) need high-purity Ala-Gln to avoid ammonium accumulation and ensure cell viability, offering steady, if specialized, downstream demand.

Animal and aquaculture nutrition. Translational research supporting benefits in livestock and aquaculture gut integrity, disease resistance, and growth performance could unlock large-volume feed markets if cost structures are optimized.

Despite the opportunities, the market faces significant obstacles.

Capital-intensity and regulatory burden. Scaling sterile production, implementing GMP, and maintaining high QC impose large fixed costs and operational complexity. Smaller producers may find it difficult to justify the investment, leading to capacity constraints or market concentration.

Raw material and input volatility. Price swings in amino-acid feedstocks, fermentation substrates, or reagent markets impact margins. For enzymatic routes, enzyme supply or licensing constraints could impede scale-up.

Technical complexity of synthesis and purification. Ala-Gln synthesis—especially at pharmaceutical grade—requires careful control of stereochemistry, minimization of side-products, and robust purification to meet endotoxin and impurity specifications. For fermentative routes, host cell protein removal and endotoxin control are nontrivial.

Intellectual property (IP) and proprietary processes. Some efficient enzymatic routes or engineered strains may be IP-protected. Licensing costs or litigation risk can raise barriers to entry or impose ongoing royalties.

Clinical evidence and perception. While Ala-Gln has recognized uses, downstream markets demand clear clinical protocols and dosing guidance. Variation in clinical outcomes, inconsistent trial designs, or lack of widely accepted guidelines in some indications can temper adoption. Convincing payors and hospital formularies of cost-benefit may require robust health-economic analyses.

Price sensitivity in non-clinical markets. Sports nutrition and animal feed buyers are often cost sensitive. Competing amino-acid forms with lower unit costs (even if inferior in stability or bioavailability) can capture volume if price differentials remain large.

Supply chain and logistics for sterile products. Sterile products have narrow handling tolerances and require secure distribution. Disruptions in cold chain, sterile packaging, or transport can lead to costly recalls or product losses.

Regulatory heterogeneity. Food, supplement, and drug classification differs by jurisdiction. Securing approvals for enteral or parenteral use in multiple geographies requires tailored dossiers, local studies, and navigation of differing maximum dose policies.

The Ala-Gln industry chain is at a stage where technical innovation, regulatory stringency, and shifting end-user expectations are jointly restructuring value capture. Over the next decade, we can expect: increasing adoption of enzymatic/fermentative production for improved sustainability and cost; continued premiumization of sterile, ready-to-use formulations for clinical nutrition; and gradual geographic diffusion of demand to emerging regions as healthcare systems modernize. At the same time, the market will remain segmented—high-value parenteral and clinical nutrition products commanding premium pricing, while bulk commodity applications in sports nutrition and animal feed will remain price-sensitive.

Companies that successfully integrate quality, sustainability, and clinical evidence—while maintaining flexible manufacturing capacity to serve both pharmaceutical and non-pharmaceutical markets—will be best positioned to navigate the obstacles identified. Long-term success also requires active engagement with clinicians and researchers to build the evidence base for new indications and to demonstrate cost-effectiveness, thereby easing payor acceptance and hospital formulary inclusion.

In essence, Ala-Gln is a specialty biochemical with a clear clinical value proposition but a manufacturing profile that demands technical excellence and regulatory rigor. The industry chain’s future will be shaped by who can lower production costs responsibly, accelerate sustainable manufacturing adoption, and translate biochemical advantages into clinically meaningful and commercially viable products.

t consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

The report provides a detailed analysis of the market size, growth potential, and key trends for each segment. Through detailed analysis, industry players can identify profit opportunities, develop strategies for specific customer segments, and allocate resources effectively.

The Alanyl-Glutamine market is segmented as below:

By Company

Ajinomoto

Jinan Chenghui-Shuangda Chemical

Kyowa Hakko Bio

Evonik

Wuhan Microsen Technology

Jiangsu Chengxin Pharmaceutical

Xi’an Lyphar Biotech

Fresenius Kabi

Segment by Type

Condensation

Enzymatic Synthesis

Others

Segment by Application

Food & Beverages

Pharmaceuticals Industry

Sports Nutrition & Supplements

Others

Each chapter of the report provides detailed information for readers to further understand the Alanyl-Glutamine market:

Chapter 1: Introduces the report scope of the Alanyl-Glutamine report, global total market size (valve, volume and price). This chapter also provides the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry. (2021-2032)

Chapter 2: Detailed analysis of Alanyl-Glutamine manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc. (2021-2026)

Chapter 3: Provides the analysis of various Alanyl-Glutamine market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments. (2021-2032)

Chapter 4: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.(2021-2032)

Chapter 5: Sales, revenue of Alanyl-Glutamine in regional level. It provides a quantitative analysis of the market size and development potential of each region and introduces the market development, future development prospects, market space, and market size of each country in the world..(2021-2032)

Chapter 6: Sales, revenue of Alanyl-Glutamine in country level. It provides sigmate data by Type, and by Application for each country/region.(2021-2032)

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc. (2021-2026)

Chapter 8: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 9: Conclusion.

Benefits of purchasing QYResearch report:

Competitive Analysis: QYResearch provides in-depth Alanyl-Glutamine competitive analysis, including information on key company profiles, new entrants, acquisitions, mergers, large market shear, opportunities, and challenges. These analyses provide clients with a comprehensive understanding of market conditions and competitive dynamics, enabling them to develop effective market strategies and maintain their competitive edge.

Industry Analysis: QYResearch provides Alanyl-Glutamine comprehensive industry data and trend analysis, including raw material analysis, market application analysis, product type analysis, market demand analysis, market supply analysis, downstream market analysis, and supply chain analysis.

and trend analysis. These analyses help clients understand the direction of industry development and make informed business decisions.

Market Size: QYResearch provides Alanyl-Glutamine market size analysis, including capacity, production, sales, production value, price, cost, and profit analysis. This data helps clients understand market size and development potential, and is an important reference for business development.

Other relevant reports of QYResearch:

Global Alanyl-Glutamine Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

Global Alanyl-Glutamine Market Research Report 2025

Global Alanyl-Glutamine Market Insights, Forecast to 2031

Alanyl Glutamine Injection- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

Global Alanyl Glutamine Injection Market Research Report 2025

About Us:

QYResearch founded in California, USA in 2007, which is a leading global market research and consulting company. Our primary business include market research reports, custom reports, commissioned research, IPO consultancy, business plans, etc. With over 19 years of experience and a dedicated research team, we are well placed to provide useful information and data for your business, and we have established offices in 7 countries (include United States, Germany, Switzerland, Japan, Korea, China and India) and business partners in over 30 countries. We have provided industrial information services to more than 60,000 companies in over the world.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

EN: https://www.qyresearch.com

Email: global@qyresearch.com

Tel: 001-626-842-1666(US)

JP: https://www.qyresearch.co.jp